In The Media

Insellerate integrates its CRM soluti...

The collaboration aims to bring “customer outreach to new heights,” according to Josh Friend, CEO of Insellerate Insellerate, a CRM provider serving banks, lenders and credit unions, announced an integration with Finastra’s MortgagebotLOS and Originate solutions on Tuesday. Thanks to this latest collaboration, lenders who use Finastra’s software will benefit from a seamless, fully integrated CRM as well as a marketing automation solution. “Finastra has a long history of delivering innovative ...

G2 High Performer badge

Amidst a year of delivering groundbreaking innovation and a steadfast commitment to enhancing the Loan Officer experience, we are honored that Insellerate’s newly introduced features and functionalities have propelled us to receive the G2 High Performer badge, which is awarded to organizations with high customer satisfaction scores in the category for CRM and Marketing Automation.

Insellerate Launches New AI Integrati...

Insellerate, Newport Beach, Calif., launched a new AI plug-in for email marketing in the mortgage industry. Users will gain access to advanced functionality powered by ChatGPT, enabling content creation, enhanced grammar correction and tone adjustments within their current email editor. Insellerate’s new AI integration is now available to all users. From the news: https://newslink.mba.org/mba-newslinks/2023/july/industry-briefs-july-19-2023/

Insellerate Revolutionizes Mortgage E...

Insellerate, a provider of Modern CRM and Marketing Automation solutions to the mortgage lending and real estate industries, has launched an AI plugin designed to transform email marketing strategies for mortgage professionals. With this new integration, users can access advanced functionality powered by ChatGPT, enabling effortless content creation, enhanced grammar correction, and expert-level tone adjustments within their current email editor. The Insellerate AI plugin empowers mortgage pr...

Path Software Launches Integration Wi...

Path Software, a modern and flexible mortgage loan origination system, is now integrated with Insellerate, a provider of modern CRM and marketing automation solutions to the mortgage lending and real estate industries. Insellerate is a highly scalable, configurable, modern CRM platform that accelerates sales and generates repeat business for lenders. Through the integration, Path users can access Insellerate platform of full CRM functionality with built-in lead management and automated market...

The 2023 Innovations Award Winners Are …

The Executive Team of PROGRESS in Lending is proud to give Insellerate our Innovations Award this year. Powered with AgentConnect, Insellerate empowers loan officers to engage more effectively with real estate agents and borrowers, resulting in higher lead conversion rates, lower origination costs, and more closed loans. AgentConnect takes co-branded marketing to a new level by automatically delivering dynamic open house flyers, property websites, and landing pages instantly through MLS data ...

Most Connected Mortgage Pros

Josh’s impact on mortgage industry is unmistakeable from his early days of working at a mortgage company, rising up the ranks, to running a mortgage company. He is transforming the borrower experience with the leading technology Insellerate, which enables lenders to intelligently engage borrowers, creating customers for life.

LenderHomePage and Insellerate Partne...

The integration between Loanzify POS and Insellerate offers streamlined multi-channel communication that increases retention and conversion rates. LenderHomePage, industry-leading mortgage point-of-sale system, announced their partnership with Insellerate, a Customer Experience Platform (CEP) that delivers lead management, sales enablement, engagement, and robust mortgage specific content libraries. Now clients of both platforms will be provided with seamless automation that maximizes loan of...

Sales Boomerang partners with Inselle...

Sales Boomerang, an automated borrower intelligence and retention system, has expanded its integration with mortgage customer experience platform Insellerate. By combining loan opportunity alerts from Sales Boomerang with Insellerate’s automated, multi-channel marketing the deal is expected to help lenders increase customer retention and convert more leads to loans. “Between home purchases, refis and home-equity loans, the average consumer will do 11 mortgages in their lifetime,” said ales Bo...

Just Announced Awarded – Top Innovati...

Just Announced- Insellerate Named Top Innovation Prominent mortgage executives gathered digitally to see who the Executive Team of PROGRESS in Lending named the top industry innovations of the past year at the Eleventh Annual Innovations Awards Event. This honor is the Gold Seal when it comes to recognizing true industry innovation. All applications were scored on a weighted scale. We looked for the innovation’s overall industry significance, the originality of the innovation, the positive ch...

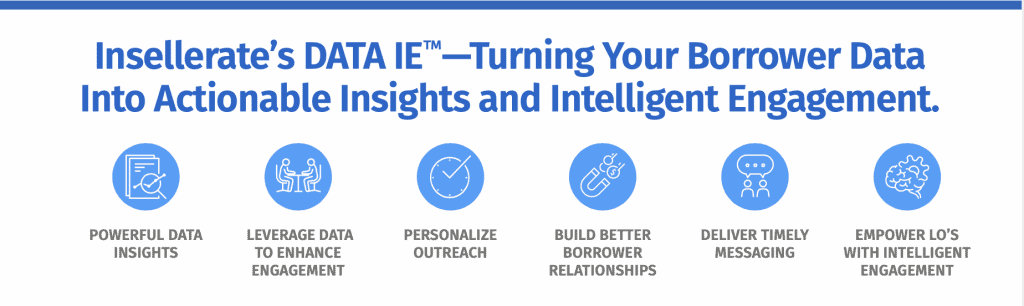

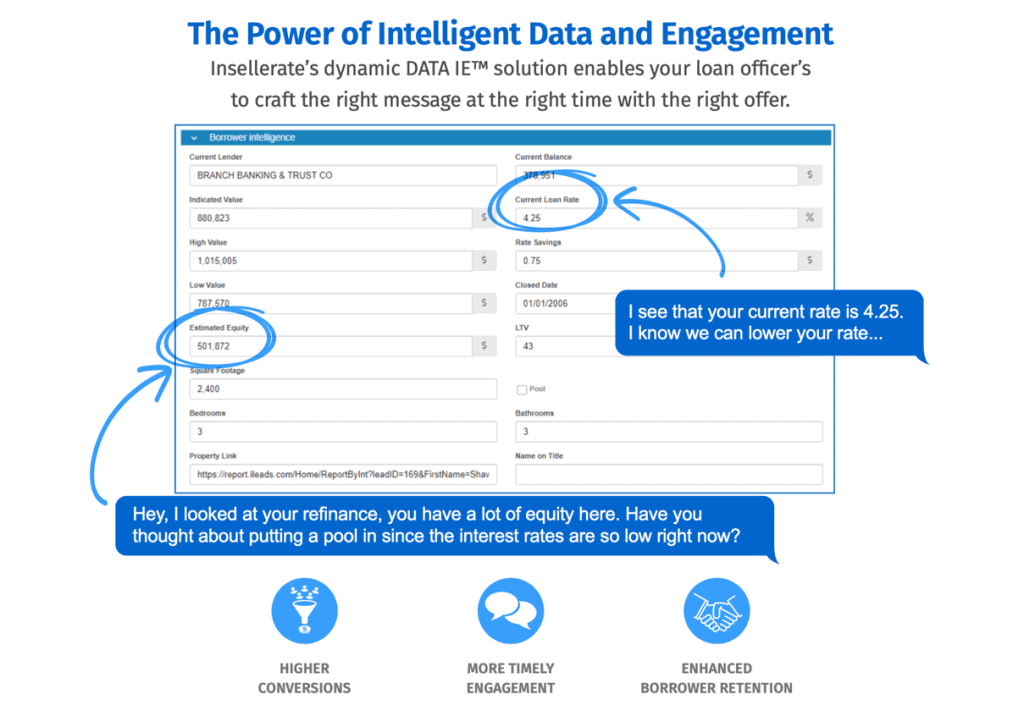

Insellerate Launches DATA IE – Indust...

Insellerate Launches DATA IE Insellerate, Newport Beach, Calif., released DATA IE, which allows lenders to better serve their customers by turning borrower data into actionable insights and intelligent engagement. DATA IE delivers data insights, leverages that data to enhance borrower engagement and provides personalized outreach to enhance borrower relationships while delivering timely messaging throughout the borrower process. It enables loan officers to craft the right message at the right...

Insellerate Launches DATA IE™ Solution

Turning Borrower Data Into Actionable Insights and Intelligent Engagement PRESS RELEASE UPDATED: DEC 2, 2020 04:00 EST NEWPORT BEACH, California, December 2, 2020 (Insellerate.com) Insellerate, the leading mortgage Customer Experience Platform featuring Lead Management, CRM & Engagement that helps lenders close more loans by increasing efficiency gains across sales, marketing, operations management, announces the release of its DATA IE solution. This innovative solution allows lenders to ...

2020 HW Tech Trendsetter: Jack Friend

Insellerate, Chief Financial Officer and Chief Operating Officer Jack Friend consistently demonstrates the ability to create vision, strategy and consensus-building for a wildly divergent group of mortgage industry stakeholders on complex technical topics, and has developed and executed large-scale technology projects that enable lenders to operate more efficiently to grow and improve their lending organizations. His ability to design and deliver innovative solutions has been used to fund bil...

2020 HousingWire Vanguard: Josh Frien...

The 2020 list of HousingWire Vanguard potential candidates was more competitive than ever before. On any other given year, many would have easily won – but this was not any other year. The competition was fierce. Josh Friend’s impact on the mortgage industry at large is unmistakable. From his early days working at a mortgage company, to rising up the ranks, to running a mortgage company, Friend has helped thousands of people realize the dream […]

Insellerate Partners With Project Hop...

Insellerate, a provider of mortgage Lead Management, CRM & Engagement Platform that helps lenders close more loans by increasing efficiency gains across sales, marketing, operations, and management, has launched a partnership with Project Hope Alliance to help close California’s digital divide in education. As students across California look to begin a new school year, thousands of students experiencing homelessness remain without access to proper Wi-Fi and technology, reflecting a digita...

Insellerate launches mobile app fully...

Mortgage CRM platform Insellerate has released a mobile app that equips loan officers with the tools they need to engage borrowers. The new app enables loan officers to distribute leads, manage pipelines, automate best practices, and personalize the borrower’s experience all through their mobile devices. Additionally, loan officers can access critical loan information without having to log into their LOS system. Insellerate’s mobile app also includes several capabilities, such as full lead ma...

Insellerate to launch CRM app for LOs...

Customer relationship management (CRM) mortgage fintech Insellerate, is ready for its next milestone. The Newport Beach, Calif., based company is launching a groundbreaking mobile app designed to transform borrower engagement by empowering loan officers with fast, full access to data and customized service options delivered through an omni-channel marketing system. The goal, Insellerate said in a press release, fundamentally is to innovate how mortgage borrowers engage with loan officers. The...

Insellerate Launches Mobile Lead Mana...

Insellerate is launching what it bills as a first-of-its-kind mobile application that will allow full access to lead management and distribution, click to call, inbound call routing, first call automation, two-way compliant text messaging and more, without having to open up a laptop or log into a loan origination software system. Insellerate stated that the new app will empower loan originators to distribute leads, manage pipelines, prioritize their days, enhance automating practices and pers...

Vendor To Further Enhance Engagement ...

In 2019, Insellerate dramatically enhanced its CRM & Lead Management solution by introducing its Marketing Automation and Engagement Platform. This new functionality automates multi-channel marketing with pre-designed content through social media, email, direct mail, compliant text messaging, ringless voicemail, and phone calls to enable better borrower engagement. Moving forward, in August Insellerate will take things even further with a new mobile approach. Lenders are growing significa...

Insellerate reports record demand for...

Mortgage marketing and sales engagement platform Insellerate has been welcoming a growing number of lender clients in the past 12 months. An additional 52 lenders are now using its highly scalable software, technology integration, strategy, and content services, the Newport Beach, Cal.,based fintech reported in a statement. Since Insellerate launched its most recent CRM & Engagement Platform in June 2017, it has processed over 2.6 million applications for its lender clients and engaged wi...

Insellerate Attributes Record Growth ...

Newport Beach, CA – July 28th, 2020 – Insellerate, the leading mortgage CRM & Engagement Platform, which helps lenders close more loans by increasing efficiency gains across sales, marketing, operations, and management, announced today that it credits its significant growth to demand for its lead management and borrower engagement tools that dramatically increase response and conversion rates. “Now more than ever, with loan officers often working remotely, it is critical to provide them w...

Webinars, Videos, & Podcasts

How to Leverage Chat GPT to Create Content that Moves the Needle

How the Right Sales Scripts & Technology Drives Production Numbers

CMBA Mortgage Innovators Conference 2021 – Tech Demo Block #1

Understanding Today’s Connected Borrower

The Big Shift: How Technology & Transparency Are Changing The Mortgage Industry

Leverage Digital to Enhance the Borrower Experience in Today’s Virtual World

Rob Chrisman and Josh Friend discussing the Industry insights and in depth conversation!

Listen to key industry insights and in depth conversations where they discuss the economy, industry trends, and provi...

LIVE Industry Update and In-depth conversation with John Kresevic, CEO JFQ Lending

Managing The Borrower Journey – Webinar with Corey Shelton SVP & Marketing – Atlantic Coast Mortgage

Radically Transforming Borrower Engagement – Madison Mortgage Services Inc. & Epoch Lending

This is how JFQ Lending Inc is winning!

Josh Friend CEO of Insellerate on Laugh, Lend and Eat with Fobby!

Explosive Keys to Your Loan Officers Significantly Outperforming National Production Numbers

Insellerate CEO Josh Friend joins MBANow

Explosive Growth When Building A Mortgage Company – JFQ Lending

Project Hope Alliance – Conversation with Jennifer Friend & Josh Friend

More Videos

How to Leverage Chat GPT to Create Content that Moves the Needle

Webinars | Aug 22, 2023

How the Right Sales Scripts & Technology Drives Production Numbers

Webinars | Jun 30, 2021

CMBA Mortgage Innovators Conference 2021 – Tech Demo Block #1

Webinars | Jun 30, 2021

Understanding Today’s Connected Borrower

Webinars | Apr 30, 2021

The Big Shift: How Technology & Transparency Are Changing The Mortgage Industry

Webinars | Apr 29, 2021

Leverage Digital to Enhance the Borrower Experience in Today’s Virtual World

Webinars | Jan 14, 2021

Rob Chrisman and Josh Friend discussing the Industry insights and in depth conversation!

Webinars | Dec 10, 2020

LIVE Industry Update and In-depth conversation with John Kresevic, CEO JFQ Lending

Webinars | Dec 04, 2020

Managing The Borrower Journey – Webinar with Corey Shelton SVP & Marketing – Atlantic Coast Mortgage

Webinars | Oct 24, 2020

Radically Transforming Borrower Engagement – Madison Mortgage Services Inc. & Epoch Lending

Video | Oct 18, 2020

This is how JFQ Lending Inc is winning!

Webinars | Oct 06, 2020

Josh Friend CEO of Insellerate on Laugh, Lend and Eat with Fobby!

Video | Jul 22, 2020

Explosive Keys to Your Loan Officers Significantly Outperforming National Production Numbers

Video | May 26, 2020

Insellerate CEO Josh Friend joins MBANow

Video | Apr 20, 2020

Explosive Growth When Building A Mortgage Company – JFQ Lending

Video | Apr 14, 2020

Project Hope Alliance – Conversation with Jennifer Friend & Josh Friend

Video | Apr 01, 2020

Articles

Where Lenders Come To Grow

The Power of Modern CRMs In Banking f...

In today’s dynamic and customer-centric banking landscape, financial institutions are on a constant quest to enhance their services and create lasting relationships with their customers. This mission is at the heart of the transformative power of modern Customer Relationship Management (CRM) systems. These sophisticated solutions have ushered in a new era of banking, allowing institutions to seamlessly collaborate across various departments and provide a holistic approach to customer en...

Accelerating Innovation in the Mortga...

The mortgage industry, often perceived as a lumbering giant, has long been associated with slow-moving processes and entrenched traditions. However, the winds of change are sweeping through this sector, ushering in an era of innovation that promises to revolutionize how we approach home buying and financing. In this article, we will explore the historical sluggishness of innovation in the mortgage industry and delve into the compelling reasons why accelerating innovation is essential for its ...

Unleashing The Power Of Marketing Aut...

In the world of mortgages, where dreams of homeownership meet the realities of financial decisions, a new revolution is unfolding – one that merges cutting-edge technology with personalization. Enter marketing automation with a built-in content library tailored for the mortgage industry. Mortgage lenders, loan officers, and mortgage brokers are reaping the rewards of this dynamic duo as they deliver the right content at the right time to the right prospective borrower. This game-changing fusi...

Insellerate Now Delivers CRM & M...

Insellerate, a provider of Modern CRM and Marketing Automation solutions to the mortgage lending and real estate industries, has launched its new TPO solution. This powerful solution provides dynamic account executive workflows, engaging marketing content, pipeline management, and more from an account executive’s mobile device. In today’s constantly changing mortgage market with rising rates, low inventory, heightened competition, and lower origination volumes, wholesale lenders and their TPO...

Revolutionize Your Mortgage Marketing...

In today’s fiercely competitive mortgage industry, standing out from the crowd is no longer an option—it’s a necessity. To capture the attention of your target audience and drive meaningful engagement, you need a marketing strategy that goes beyond the ordinary. That’s where a brand-new mortgage-specific content library comes in. This game-changing platform is poised to transform your mortgage marketing efforts by providing a highly engaging, thought-provoking, and compelling experience for y...

Transforming Mortgage Lending With Po...

In the competitive mortgage lending world, harnessing data’s power has become essential for success. With the advent of advanced analytics tools like Power BI, mortgage professionals now have the means to unlock valuable insights that can drive business growth and foster deeper connections with borrowers. This article explores how Power BI can revolutionize the mortgage industry by revealing data-driven insights, enabling lenders to close more deals and build stronger borrower relationships. ...

What Customer Service Looks Like

Have you ever wondered what good service means? It’s about more than just everything working perfectly or being fast and easy. I recently stayed at the Wynn for the Ice Technology conference, and the staff at the Wynn reminded me of what good service truly entails. Sure, they missed a few things and even forgot to clean my room one day, but every person I spoke to had shown that they genuinely cared about my […]

Driving Down The Total Cost of Mortga...

With the mortgage market demanding more from you and your team than ever before, it’s no wonder that lenders are feeling the pressure to produce. The complexity of this constantly changing environment overwhelms lenders- low origination volumes, declining revenue, rising rates, heightened pressure to reduce loan production costs, and fierce competition is challenging every lender. The mortgage industry is a highly competitive market that requires lenders to be innovative and efficient to stay...

Why Should Lenders Take The Time To E...

With the mortgage market demanding more from you and your team than ever before, it’s no wonder that lenders are feeling the pressure to produce. The complexity of this constantly changing environment poses an overwhelming burden on lenders- low origination volumes, declining revenue, rising rates, heightened pressure to reduce loan production costs, and fierce competition is challenging every lender. Times like these require every lender to re-evaluate their current tech stack. Is our techno...

3 Reasons Borrowers Say No

As a former loan officer and lending executive I have had the opportunity to train thousands of loan officers and production teams in the mortgage industry. What I learned was that there are three primary reasons a borrower says no. When loan officers learn to overcome these objections, they can close significantly more loans. Here are three reasons why borrowers say no. The assumption is that you can save them money or help them. They […]

Insellerate launches TPO solution for...

Insellerate TPO offers account executive workflows, marketing content, pipeline management, and other features Mortgage lender CRM and marketing automation solutions provider Insellerate has launched a new third party origination (TPO) solution for wholesale lenders, the company announced on Monday during ICE Experience. Insellerate TPO will provide account executive workflows, marketing content, pipeline management at the company and individual broker levels and other services, according to ...

Successful mortgage lending starts wi...

What happens when borrowers can’t or won’t walk into a lending branch? HousingWire recently sat down with Insellerate CEO Josh Friend to discuss that very question and what strategies retail lenders should look to adopt from direct-to-consumer lending. HW: What are some strategies that retail lenders should look at adopting from direct-to-consumer lending? Josh Friend: Amid this global pandemic, mortgage rates have been at historically low levels, borrower demand has increased, refi’s have br...

Innovations Award Winners Speak Out

The PROGRESS in Lending Innovations Award Winners talk about the future of mortgage lending. Mortgage executives came together to attend PROGRESS in Lending Association’s Eleventh Annual Innovations Awards Event digitally. We named the top innovations of the past twelve months. After that event, we wondered what would happen if we brought together executives from the winning companies to talk about mortgage technology innovation. Where do they see the state of industry innovation right now? A...

Understanding Today’s Connected Borrower

Today’s borrower is tech-savvy, digitally focused, and want’s communication to be frequent, timely, personal and highly engaging through multiple channels. The borrower’s expectations have changed dramatically over the last couple of years. Many stating the “Amazon Effect”, instantly search for a product, read reviews, click to order, and the product is often delivered to their home the next day. The challenge for the mortgage industry is that historically the industry has been transaction fo...

What Trends Will Shape the Originatio...

Story from January edition of MReport Amid the economic havoc created during the coronavirus pandemic, the residential mortgage industry emerged as one of the relatively few bright spots in an otherwise dismal environment. That is not to say the industry didn’t face its share of challenges – rapidly changing federal regulations, the impact of social distancing protocols on a traditionally person-to-person business and the abrupt migration from offices to working from home were among the [&hel...

Volumes & Communication Impactin...

Amid this global pandemic, mortgage rates have been at historically low levels; borrower demand has increased, refi’s have broken records, while lenders have had to shift in many instances to a remote workforce. With record-low mortgage rates driving sustained borrower demand, MBA forecasts mortgage originations to total $3.18 trillion in 2020 – the most since 2003 ($3.81 trillion). The Mortgage Bankers Association (MBA) announced that purchase originations are expected to grow 8.5% to a new ...

Loan Officer Mobility

Everything is going digital today— zoom parties, virtual happy hours, virtual open houses—which means that your team needs to be available virtually. To highlight how important it is to be virtually available, MIT studied online leads. It found that if you call a lead in the first five minutes versus one hour, you’re one hundred times more likely to get a hold of them. Call a lead in five minutes versus thirty minutes. You’re going […]

Insellerate: Sales and Marketing Enga...

Introducing the Next Wave of Mortgage Technology. The first of its kind solution for the mortgage industry, Insellerate’s Sales & Marketing Engagement Mobile App automates In-bound call routing, lead distribution, full lead management, remote call tracking, click to call, and pipeline management. It even automates multi-channel marketing through social media, email, direct mail, compliant text messaging, ringless voicemail, and phone calls to enable better borrower engagement from the pal...

Data Insights And Its Impact On Borro...

The Insellerate platform, in the last three years alone, has handled over 2.6 million borrower applications and 66 million prospects. So if you take a look at how many touchpoints each one of those has had, we’re talking about hundreds of millions of different touchpoints and data points throughout the borrower’s journey. This data provides excellent insights into what’s happening throughout the mortgage process with consumers and the trends impacting borrower engagement. Brand loyalty in [&h...

How is technology transforming borrow...

About Josh Friend and Insellerate Josh Friend began his career as a loan officer and soon moved on to open six mortgage call centers. Over the past 21 years, he has grown to manage and train thousands of loan officers, processors, and marketing managers. That experience has helped him market to millions of consumers, with that experience he has dedicated himself to building software for the mortgage industry since 2004. With a keen eye for […]

Transforming Borrower Engagement Thro...

In today’s rapidly changing lending environment, it is critical to identify solutions that are working and producing actual results for other lenders. Pipelines are full; employees are working remotely, and communicating with your prospective borrowers is more critical than ever. That’s why I spoke with two lenders that are producing significant results to share their stories to assist you along your journey. John Kresevic, CEO of JFQ Lending, and Nick Rutherford, Director of Business Develop...

Long Live Direct Mail: 5 Best Practic...

In today’s climate, marketers have to get pretty creative if they want to earn the attention of borrowers. Many lenders have seen great success nurturing online leads through digital marketing channels. With so many ways to reach consumers online, offline channels should not be forgotten because the truth is: Direct mail is not dead. To earn the attention of the modern borrower, it’s best to leverage a mix of online and offline marketing channels. Here […]

Research + Case Studies

How Borrowers And Lenders Behave

A guide to optimizing client engageme...

With 2023 off to a challenging start, mortgage professionals are buckling in for another year of ebbs and flows. Rising rates, low inventory, heightened competition and low origination volumes all add to the turbulent landscape lenders are looking to navigate through. In order to find success in 2023, professionals need to find strategic solutions that not only drive purchase volume but also build strong relationships that lead to steady business. The 2023 borrower is tech-savvy […]

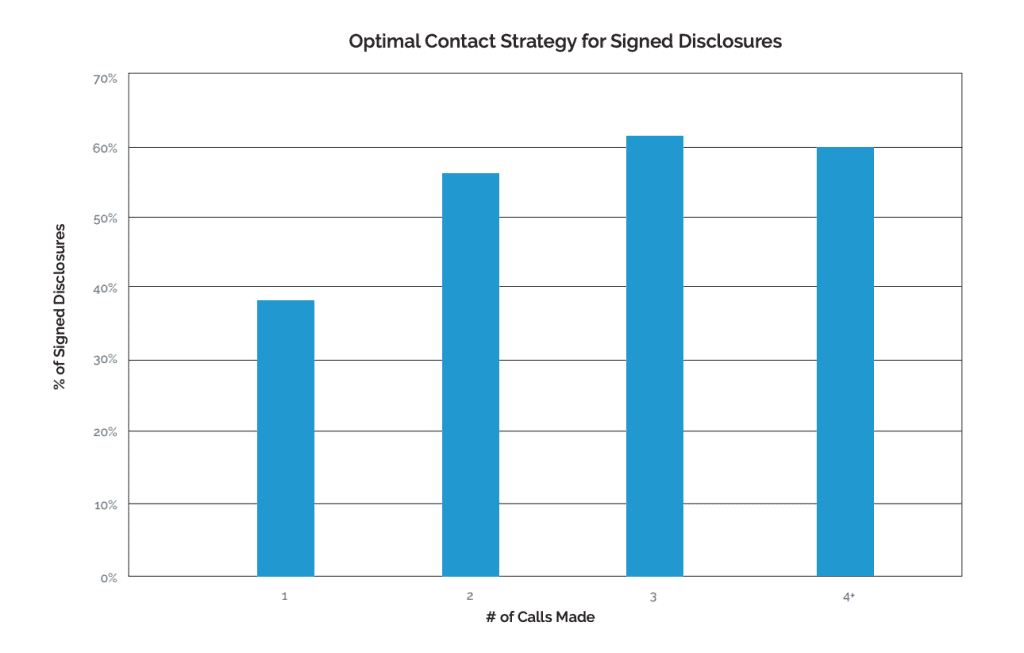

Call 3 Times in the First 24 Hours

Fact: 61% of initial disclosures come back when borrowers are called 3 times in the first 24 hours. The Insellerate research team took a look at 3,200 sent disclosures to get a better understanding of the relationship between time, effort, and getting initial disclosures back. The study examined the rate of returned disclosures over a period of 96 hours. The findings reflect an optimal contact strategy of at least 3 calls within the first 24 […]

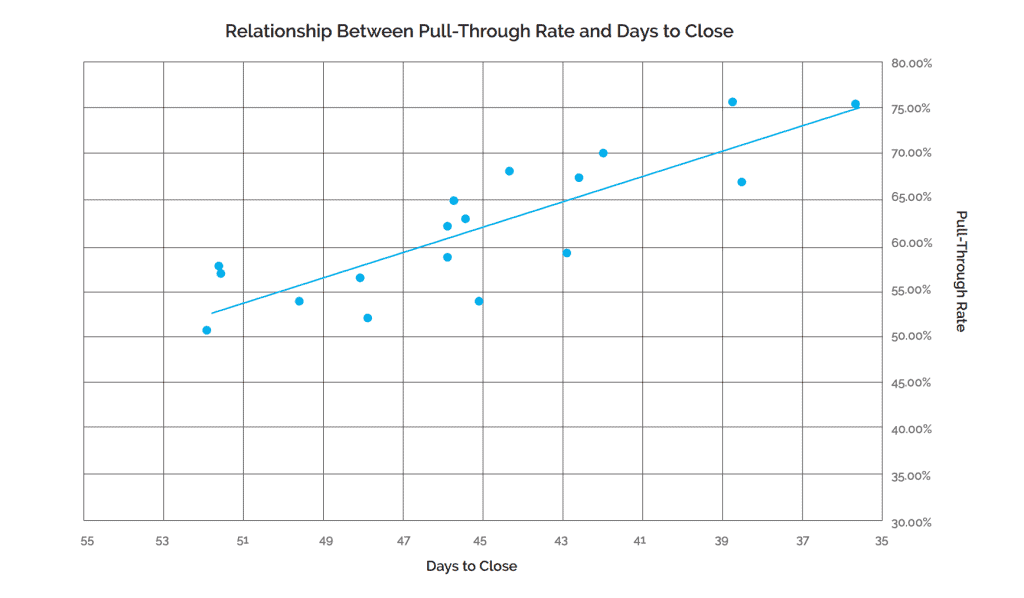

Shorten Your Sales Cycle

Fact: For each day shaved off your total days to close, pull-through rate increases by 1% The Insellerate research team took a look at more than 1,000 funded loans to get a better understanding of the relationship between time and funding success. The average time to close for all loans in the study fell between 35-52 days, with pull-through rates between 51-75%. The study found a negative correlation between the two—a decrease in number of […]

4 Sales Plays That Lose Mortgage Serv...

As a mortgage servicer with quite an active customer base, you have already started building relationships. Relationship-building should never stop there, after the papers are signed and the funds are deposited. Each of these customers, already in your pipeline, are recurring revenue opportunities for you as a mortgage servicer. Avoid making the mistake of letting this revenue slip through your fingers. It’s important to focus on providing exceptional customer service not only in the beginnin...

Long Live Direct Mail: 5 Best Practic...

In today’s climate, marketers have to get pretty creative if they want to earn the attention of borrowers. Many lenders have seen great success nurturing online leads through digital marketing channels. With so many ways to reach consumers online, offline channels should not be forgotten because the truth is: Direct mail is not dead. To earn the attention of the modern borrower, it’s best to leverage a mix of online and offline marketing channels. Here […]