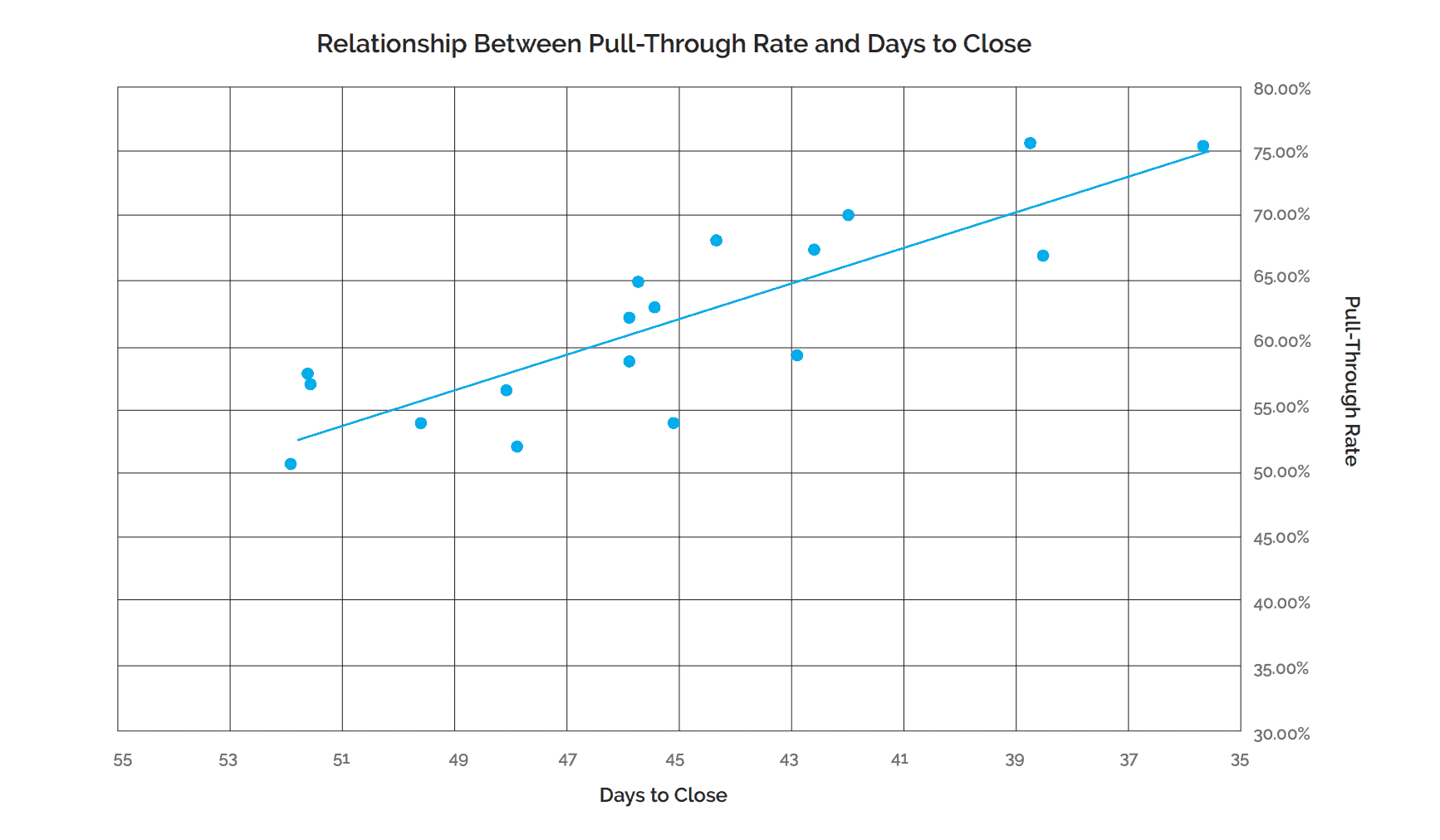

Fact: For each day shaved off your total days to close, pull-through rate increases by 1%

The Insellerate research team took a look at more than 1,000 funded loans to get a better understanding of the relationship between time and funding success. The average time to close for all loans in the study fell between 35-52 days, with pull-through rates between 51-75%.

The study found a negative correlation between the two—a decrease in number of days to close correlated to an increase in pull-through rate. In fact, as much as a 1% increase in pull-through rate can be seen for each day the sales cycle is shortened.

How to Shorten Your Sales Cycle

- Use SMS text messaging for quick inquiries or reminders

Save telephone and email conversations for detailed requests that might require more back and forth communication. SMS text messaging is good for reminders and engagement that won’t require a lot of dialogue. This saves your team time and money, and helps keep deals moving through the pipeline faster.

- Leverage CDR (call detail records) to manage inefficiencies in real-time. or reminders

The CDR provides the visibility you need to improve loan officer efficiency on the phone. For each LO, you can see the number of calls made, when they were made, talk time, and lead status. Even more, you can listen to call recordings to identify what is working and what isn’t, so that you can coach your team to success. Leverage this information to identify the gaps that are slowing down your average number of days to close

- Set up alerts for LOs that prioritize lead activities that are closer to being funded

LOs can get caught up in making contact attempts to generate new business. But when a borrower takes action that signals an interest in moving forward, like signing an “intent to proceed,” follow-up activities should take precedence

For more information, contact sales@insellerate.com.

Recent Comments