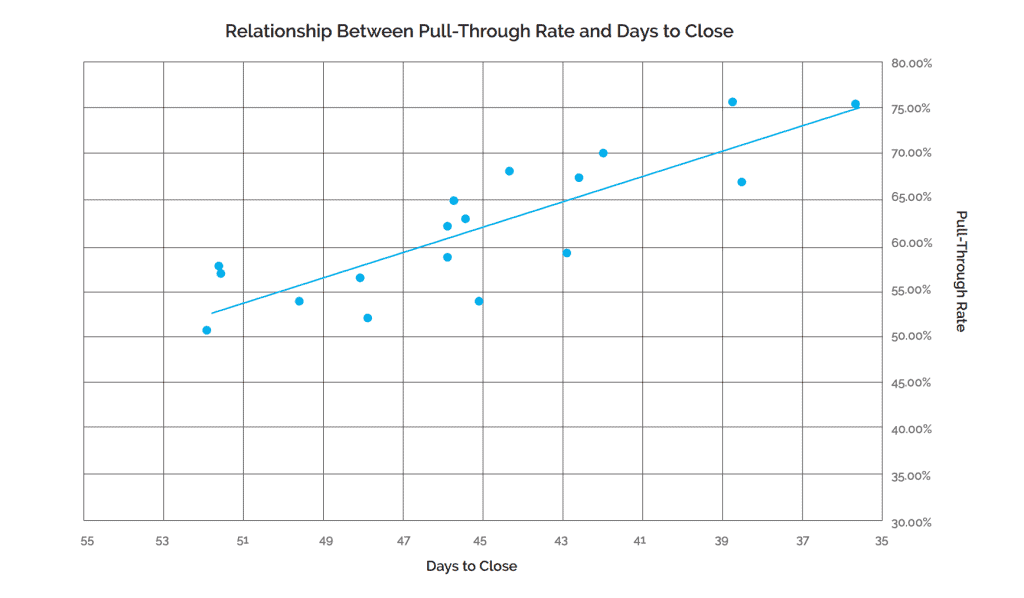

Shorten Your Sales Cycle

Fact: For each day shaved off your total days to close, pull-through rate increases by 1% The Insellerate research team took a look at more than 1,000 funded loans to get a better understanding of the relationship between time and funding success. The average time to close for all loans in the study fell between 35-52 days, with pull-through rates between 51-75%. The study found a negative corr...