In today’s climate, marketers have to get pretty creative if they want to earn the attention of borrowers. Many lenders have seen great success nurturing online leads through digital marketing channels. With so many ways to reach consumers online, offline channels should not be forgotten because the truth is: Direct mail is not dead.

To earn the attention of the modern borrower, it’s best to leverage a mix of online and offline marketing channels.

Here are five best practices to do so through one very effective offline channel – direct mail:

1. Avoid the dirty data dilemma.

Are you sending your letter to the right person? If you’re caught in the dilemma of dirty data, your direct mail campaign isn’t going to get very far. This is the first step in creating an effective offline marketing strategy: make sure your data is clean. It needs to be current and accurate.

There are many different types of data, but the two main ones are invitation to apply (ITA), which usually comes from county recordings and public records, and pre-screened, which comes from the credit bureaus. With pre-screened data, you can select your target customer based on FICO score, payment history, loan balance, loan type and overall amount of credit. When buying data, it’s a good idea to use a reputable data vendor.

2. Make it pretty.

Whether or not your direct mail piece gets opened depends on how well it’s designed. There are a lot of variables, from the decision to use a professional designer to choosing the size of the letter, colors, paper quality, type of postage, the return address and promotional language on the envelope. Keep in mind that most consumers are very aware of what mail solicitations look like. If you want them to open your mail, it has to stand out.

3. Master the message.

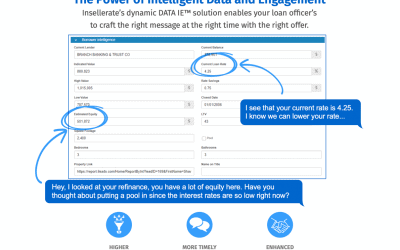

Gone are the days of spray-and-pray messaging. Think of the mail you receive, do you take time to look at each piece? Probably not. Today’s consumer has the luxury of tuning you out, so lenders need to take a more targeted marketing approach. Look at the details of your database and leverage them to create specific messaging. Segment your list if you have to. The more targeted your message, the better.

For example, if you are offering cash-out refinances to someone, does your piece explain how much they could get, or mention the kinds of things they could do with the money? Are you letting FHA borrowers know they can refinance into today’s lower rates without having to get an appraisal? Whatever your message, it has to match the needs of your prospects, and it needs to be relevant.

4. Make an offer.

The difference between a public service announcement and a marketing play is whether you include an offer in your message. Without stating what you will do for the consumer, or your offer, your direct mail piece is just a helpful piece of information. Give consumers a reason to talk to you by stating what you will do for them. Are you offering a lower rate? A free appraisal? Cash-out refi? Say so, and be precise.

5. Always have a call-to-action.

The worst thing is not having a call-to-action. At the most fundamental level of your campaign, you’ll need a call-to-action so you can track the success rate – and more importantly, generate the business that you meant to generate with this effort.

Very simply put, what are you asking the borrower to do? Whether you want someone to call your phone number, visit a website or send in a form, the call-to-action should be very clear and easy to understand.

Keep these best practices a staple of every direct mail campaign. Get creative and test different variables for each. See what design, content, and calls-to-action generate the most traction. Through all the A/B testing you do, don’t forget to always track and measure success so you can continue to improve future campaigns.

Recent Comments