Revolutionizing Lending with AI-Powered Technology

Uncover the incredible impact of game-changing technology on sales management, loan officer productivity, and the customer journey like never before.Book a DemoLearn more

Sales Manager Efficiency

Enhancing Sales Management With AI

- Easily turn Artificial Intelligence insights into actionable events utilizing Open AI.

- Increase Sales manager effectiveness and lower sales management cost by automating call reviews.

- Our AI-powered solution offers real-time call monitoring, coaching, and insights, reducing sales management costs significantly.

Loan Officer Efficiency

Empowering Loan Officers with AI Insights

-

Lower wasted time of Loan Officers by calling and speaking to borrowers that don’t qualify or need a loan.

-

Increase loan officer efficiency by giving them the right leads to call based on deal probability and intelligent notes.

-

AI analyzes customer data to provide personalized insights, helping loan officers offer the right loan quickly.

Enhanced Customer Experience

Delivering Personalized Customer Interactions

-

Improve the borrower experience by reducing repeated conversations and providing marketing and actionable follow-ups based on specific needs.

-

AI enables loan officers to engage customers with relevant, personalized conversations, driving satisfaction and loyalty.

Integration and Flexibility

CRM Agnostic

-

Easily integrates with any CRM, allowing for customization and optimization based on specific business requirements.

-

Can be utilized for any sales or customer service channels or needs beyond mortgage, making it highly adaptable and future-proof.

AI Call Assistant

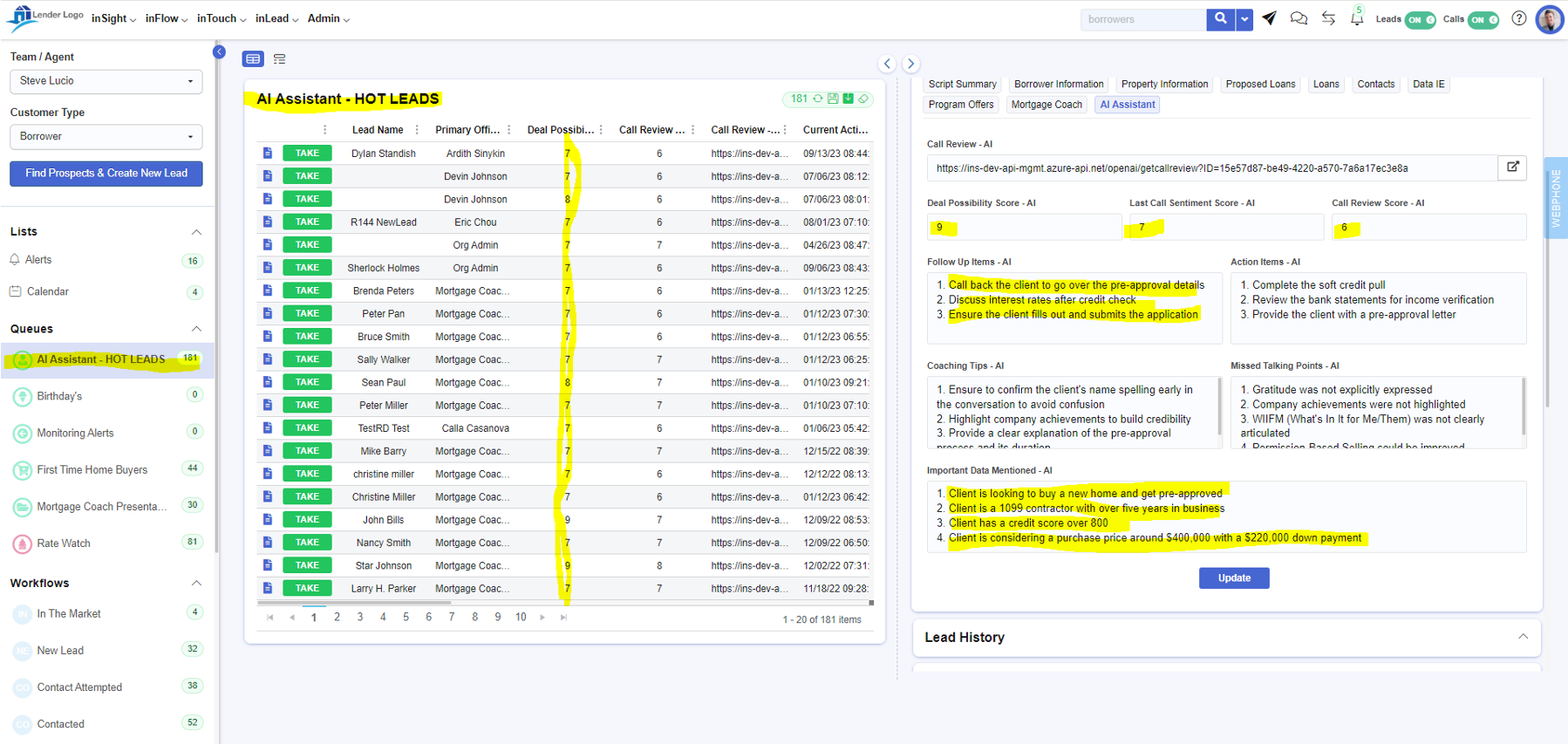

Hot List

AI Call Assistant

Sentiment Analysis

Understand the general tone and customer interest based on advanced AI models to determine:

- Customer interest

- Loan officer performance

- Overall customer sentiment

- Call outcome

Important Data

- What were the specifics of the call?

- Current loan amount

- Value of home

- Income amount

- Credit

- Amount for down payment

- When they are looking to buy?

- Do they have a realtor?

- Who is on the loan?

- Contact information

- And other important information.

Action Items

Based on the call what are the next steps? Example:

- Pull credit

- Send rates

- Update loan application

- Send over contact information for realtor

- Send disclosures

- Borrower to send over bank statements

Deal Possibility Assessment

AI can determine whether the customer has the potential to qualify for and need a loan, based on:

- Credit

- Income

- Loan to value

- Need

- Benefit

- Implied or expressed interest

And other variables.

Coaching Tips

Easy to follow specific coaching tips based on the call. Example:

- Whether they confirmed the best time to call

- Clarified a question

- Need to build more rapport with small talk

- Need to build credibility

- And other many other intelligent tips

Follow Up

Based on call what are the follow up items? Example:

- Call in a day to review loan options

- Discuss down payment with borrower

- Clarify income and review tax returns

- Email update disclosures

Call Review

Score your Loan Officers or CSR’s based on general sales technique and rules plus any custom desire.

-

Did they build rapport?

-

Did they clearly explain the option?

-

Did they listen to and address the customers needs?

-

Did they ask for the business or any other specific needs?

-

Company values

-

Compliance

Missed

Key items missed on call. Example:

- Did they state their NMLS number?

- Did they verify the email address?

- Did they use permission-based selling?

- Did they build credibility?

- Did they use the company mission statement?

- Did they advise the call was being monitored or recorded?