| About Josh Friend and Insellerate Josh Friend began his career as a loan officer and soon moved on to open six mortgage call centers. Over the past 21 years, he has grown to manage and train thousands of loan officers, processors, and marketing managers. That experience has helped him market to millions of consumers, with that experience he has dedicated himself to building software for the mortgage industry since 2004. With a keen eye for developing best-in-class sales processes, he leveraged automation & engagement software to build a better loan cycle. Combining the best from both a CRM and lead management system, Josh now enables lenders to achieve higher revenue goals with Insellerate’s award-winning CRM & Engagement Platform. Insellerate helps lenders close more loans through better borrower engagement. The mortgage industry’s most innovative marketing and sales engagement platform. We deliver dynamic technology, strategy, and content for every channel of your business to ensure engagement throughout the borrower’s journey. Insellerate’s Mobile App automates In-bound call routing, lead distribution, full lead management, remote call tracking, click to call, and pipeline management. It even automates multi-channel marketing through social media, email, direct mail, compliant text messaging, ringless voicemail, and phone calls to enable better borrower engagement from the palm of a loan officers’ hands. Insellerate integrates with the software that is powering your business today and into the future. Insellerate is a highly scalable, configurable, and modern platform that accelerates the sales process and generates repeat business. SOC 2 and SSAE 18 certified, Insellerate is built to satisfy the most closely regulated businesses, including banks with mortgage subsidiaries. For more information, visit https://insellerate.com, or contact us at 855-973-1646 Contact info: |

|

| Q1 In today’s current market, with many staff working remotely, what mobile technology is vital for lenders to be using during this pandemic? |

| For the mobile tools to be useful, they need to provide remote users the same experience as if they were in the office on their desktop. The challenge remotely is the multitude of devices (laptop, cell phone, tablet) that remote workers are using, and unfortunately, many currently technologies force the remote worker to leave their cell phone and go to their desktop or laptop to complete the task. Therefore, even with all of these different types of devices being deployed, the right mobile solution delivers the same experience to the loan officer and their borrower regardless of device.

For example; the loan officer wakes up and grabs their cell phone, instantly they are notified of the loan files they need to work on today, who they need to call and text and right from the same application on their cell phone or tablet they can compliantly text their borrower, return calls with one click while managing their leads and pipeline and connecting with their realtor partner, all from their mobile device. They can also quickly check the status of a loan, submit it to underwriting, and check to make sure that it is clear to close for funding all from the palm of the loan officers’ hand. That’s why it is vital to provide your remote workers with mobile solutions that improve conversions, enhance borrower engagement, and streamline processes to enhance operational capacity. |

| Q2 How is technology transforming borrower engagement? |

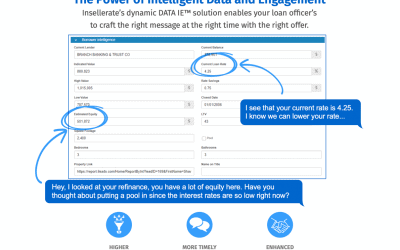

| Many antiquated CRM systems or outdated lead management systems are prevalent in many mortgage companies. These systems limit a lender’s ability to engage borrowers, putting them at a significant competitive disadvantage.

The innovative technology that drives better borrower engagement is dramatically more than just a CRM or lead management system. This advanced technology includes marketing automation, enhanced CRM functionality, mobile application, pre-built workflows, and compliant content that is highly responsive. It supports retail, consumer direct, and wholesale channels all on one platform. Highlights of the Most Advanced CRM & Engagement Platforms include: Today’s most advanced CRM & Engagement platform delivers multi-channel engagement through text, social media, email, ringless voicemail, and direct mail. Also, the solution easily integrates into a lender’s current technology stack today and into the future. It is this powerful combination that allows lenders to transform borrower engagement. |

| Q3 What is the correlation between mortgage industry experience, advanced technology, and the ability to consistently deliver innovation to the marketplace? |

| It’s hard to say the pandemic hasn’t touched every aspect of lending, and life in general, since it has changed the way we do things. I’m seeing property owners and investors embrace this new landscape by taking advantage of virtual business processes. Appraisals, inspections and discussions are virtual, which enables us to be more efficient for our clients with loan applications.

With a second spike of COVID-19 occurring in California, there is worry that another shutdown will be mandated, which would stall business, so property owners are pushing forward with their deals while they can. It is Greystone’s mission to be there to support them whatever their timeline may be, provide certainty of execution, and we hope we can be valuable stewards during this difficult and uncertain time. |

How is technology transforming borrower engagement? – Featured Article by the CMBA in their member spotlight.

Articles/Blogs

Recent Comments