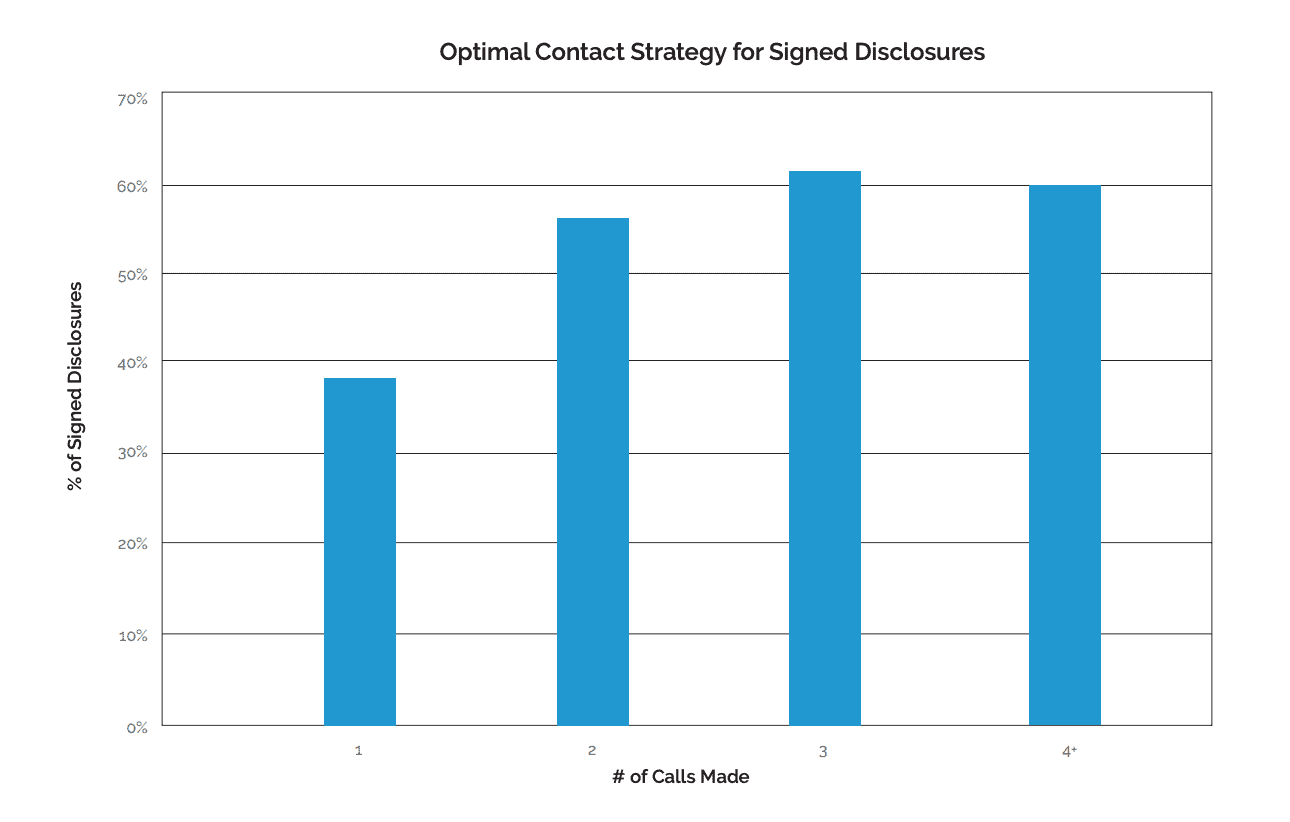

Fact: 61% of initial disclosures come back when borrowers are called 3 times in the first 24 hours.

The Insellerate research team took a look at 3,200 sent disclosures to get a better understanding of the relationship between time, effort, and getting initial disclosures back. The study examined the rate of returned disclosures over a period of 96 hours.

The findings reflect an optimal contact strategy of at least 3 calls within the first 24 hours. When loan officers followed this cadence, 61% of borrowers signed and returned the initial disclosures. Loan officers who did not follow this optimal call strategy saw as low as a 38% return rate.

How to Get Initial Disclosures Back in 24 Hours

Leverage SMS text messaging

Support call efforts with text messaging. Texts are harder to ignore and easier for consumers to respond to.

Build the 3-call strategy into your workflow.

As soon as lead status reflects sent disclosures, automate contact attempts for loan officers. Set up three contact attempts throughout the first 24 hours until the borrower signs the initial disclosures.

For more information, contact sales@insellerate.com.

Recent Comments