Meeting today’s borrower demands requires innovation & a customer-centric mindset.

Borrower expectations have changed dramatically over the last couple of years. The housing industry has not escaped the “Amazon Effect,” in which consumers expect to instantly search for a product, read reviews, click to order and have the product delivered shortly after. In addition to quick, digital service, consumers desire and expect communication to be frequent, timely, personal and highly engaging through multiple channels.

That’s a tall order for an industry that is historically more transaction-focused than relationship-focused. This problem is magnified as we transition from a refi boom to a heavy purchase market.

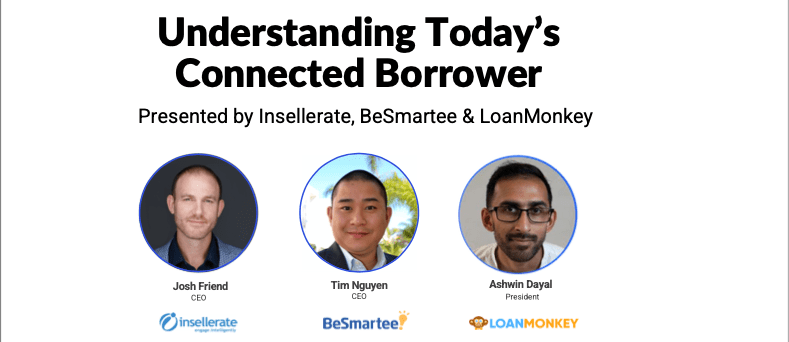

Join Ashwin Dayal from LoanMonkey, BeSmartee CEO Tim Nguyen and Insellerate CEO Josh Friend to learn how to transform the borrower journey from transaction to relationship and gain a significant lift in production in today’s digital lending environment.

Leverage collaborative technology offerings to:

- Close more loans

- Improve borrower conversions

- Enhance customer retention

- Transform your customer acquisition lifecycle

- Create customers for life

The average borrower will get 7-11 loans over the course of their lifetime; however, most borrowers will never go back to their original lender, leaving an enormous amount of business on the table.

Recent Comments