With 2023 off to a challenging start, mortgage professionals are buckling in for another year of ebbs and flows. Rising rates, low inventory, heightened competition and low origination volumes all add to the turbulent landscape lenders are looking to navigate through. In order to find success in 2023, professionals need to find strategic solutions that not only drive purchase volume but also build strong relationships that lead to steady business.

The 2023 borrower is tech-savvy and digital-first. They want communication to be frequent, timely, personal and highly engaging through multiple channels. Borrower expectations have changed dramatically over the last couple of years with many demanding the fast pace they are used to when it comes to making an online purchase.

“That means ramping up communication—keeping customers informed throughout the lending process and ensuring consistent and effective communications through all channels. Unfortunately, less than one in three customers say their lenders were able to deliver that optimal experience,” said Craig Martin, executive managing director and global head of wealth and lending intelligence at J.D. Power.

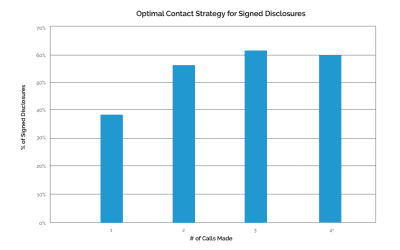

As lenders develop their strategies for the year ahead, a focus on communication is key and knowing what communication works best requires reliable data to lead the way.

This white paper will provide an overview of the importance of customer communication in the mortgage industry and offer data-backed insight into building an effective communication strategy for the coming year.

Email us for a copy marketing@insellerate.com

Publisher: Insellerate

Also published on Housing Wire

Recent Comments