What happens when borrowers can’t or won’t walk into a lending branch? HousingWire recently sat down with Insellerate CEO Josh Friend to discuss that very question and what strategies retail lenders should look to adopt from direct-to-consumer lending.

HW: What are some strategies that retail lenders should look at adopting from direct-to-consumer lending?

Josh Friend: Amid this global pandemic, mortgage rates have been at historically low levels, borrower demand has increased, refi’s have broken records and lenders have had to shift in many instances to a remote workforce. In addition to moving to a remote workforce, most face-to-face interaction with borrowers has either not been allowed to occur or the borrower’s willingness to meet has declined dramatically. That has caused a significant shift to a digital lending model that has significantly impacted a lender’s ability to do business during these challenging times.

Record low-interest rates have driven U.S. home sales to a 14-year high and spurred a 200% annual increase in refinancing. While this boom in volume has generally been positive for primary mortgage originators, it has also exposed underlying weaknesses in their digital strategies that could create challenges down the road. According to the J.D. Power 2020 U.S. Primary Mortgage Origination Satisfaction Study, mortgage originators’ shortcomings in self-service tools for application and approvals, frequent communication and extended loan processing times could negatively affect customer satisfaction over time.

These elevated levels of origination during a global pandemic have forced lenders to embrace technologies that allow them to operate remotely while finding ways to engage borrowers. What has begun to emerge is a hybrid digital lending model that converges principles of consumer direct and retail lending. Let’s start with what these traditional models look like.

Retail lenders originate loans through their in-person retail branches. Typically they rely on branch traffic, referral partners, and in-branch loan officers interacting with potential borrowers face-to-face to originate loans.

Consumer direct lending is a method for lenders to originate loans through an online experience for completing the entire loan process digitally. Typically these loan originators rely on lead sources, call centers, and other marketing activity to drive inbound leads to their consumer direct loan officers.

We’ve seen an influx of lenders asking us about our consumer-direct experience and the digital lending solutions needed to compete. Our retail lenders are saying “We’re launching consumer-direct shops.” Other large retail lenders come and say, “Hey, listen, we heard you guys are great at consumer direct.” People are moving more and more to a consumer-direct model due to the pandemic and the inability of retail loan officers to meet with their customers in the same manner that they used to.

COVID-19 has not only accelerated this adoption, but it has forced retail lenders to rethink how they are going to engage customers in this digital world. That’s where this hybrid digital lending model has emerged.

For the lenders who embrace this new hybrid model, it is a way for them to increase capacity more than they ever have before. The key for this new hybrid model to be successful lies in a lender’s ability to provide superior customer service by developing the right culture of service, implementing innovative technology that allows lenders to engage borrowers during each step of the borrower’s journey where the borrower it at.

HW: How is data intelligence and retention impacting lenders?

JF: Customer engagement depends on the speed at which lenders respond to today’s consumer inquiries and the effectiveness of the personalized communication. To communicate and genuinely connect with today’s consumers, lenders need to personalize touchpoints throughout the customer’s journey, while making each engagement relevant to the prospect’s specific business requirements.

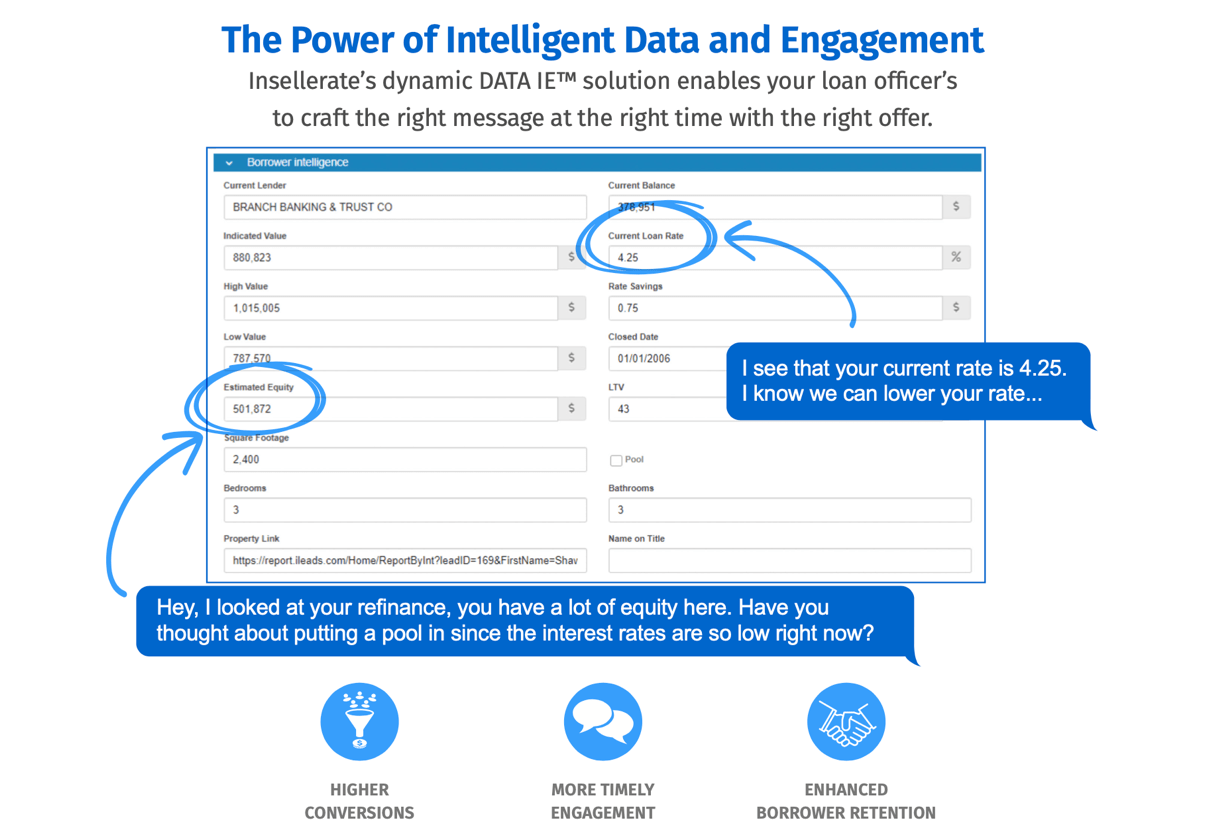

That begins with data intelligence so the information and outreach are highly personal, relevant and timely to each specific borrower.

HW: How can lenders leverage data intelligence to reach borrowers with the right message at the right time?

JF: To serve customers better, lenders need to leverage data intelligence to build lasting relationships. Data intelligence allows lenders to build rapport with relevant information and personalized outreach, strategically timed for the greatest impact. These powerful data insights are instantly actionable by the loan officer.

This transforms your customer’s journey by serving up relevant, timely content through multiple channels to maximize engagement.

HW: How does Insellerate help further borrower engagement and create customers for life?

Insellerate transforms the borrower journey from transaction to relationship.

Insellerate’s Customer Experience Platform delivers lead management, sales enablement, engagement, a robust content library and data intelligence all in one comprehensive platform.

This dynamic solution seamlessly fits into your tech stack and allows you to communicate through multiple channels: text, social media, email, direct mail, phone, ringless voicemail and retargeting. This provides you with the ability to give your customers timely, relevant information based off of data intelligence to build repeatable outcomes at each stage of the customer’s journey, changing customer experience forever.

- Close More Business

- Improve Conversions

- Enhance Retention

Click here to schedule a personal demonstration and see how Insellerate can help you create customers for life.

Published on Housing Wire

Recent Comments